Homepage > CMRC understandings > 【CMRC】Development trend of China railway standby power supply

Hits:2248 Createtime:2024-01-18 16:22:55

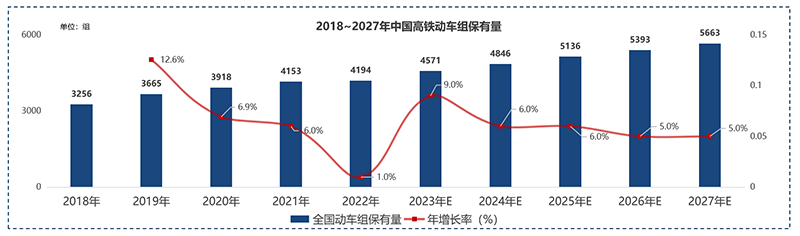

Number of high-speed rail EMUs in China:

According to the data of the National Railway Statistical Bulletin, the number of high-speed rail EMU units in China from 2018 to 2022 has continued to grow, from 3,256 standard groups in 2018 to 4,194 standard groups in 2022. Despite relatively slow growth in 2022 due to the impact of COVID-19, it is expected to show relatively good growth in 2023.

In the future, with the continuous advancement of China's high-speed rail construction and the increase in transportation demand, the number of high-speed rail EMU units is expected to continue to grow in the next few years, and the compound annual growth rate is expected to be about 5%.

Data source: Beijing Research Century Consulting

Figure 1 Projected number of China's high-speed rail EMUs from 2018 to 2027

The proportion of energy storage battery materials in high-speed rail standby power supply and future trend prediction:

At present, cadmium-nickel batteries account for about 90% of the railway standby power supply market, and lead-acid batteries and lithium titanate batteries account for about 10%. It is expected that in the next 5-10 years, cadmium-nickel batteries will also be used as the main battery material for railway backup power supply; Lead-acid batteries will be withdrawn from the market; With the development of technology, the market share of lithium titanate batteries will continue to rise.

① Cadmium nickel battery is the most commonly used energy storage battery material for railway standby power supply at home and abroad. The backup power supply of most models of Fuxing and Harmony are mainly cadmium nickel batteries, which have the characteristics of wide temperature range (general working environment temperature -40℃ to 45℃), long cycle life, strong reliability and high cost performance, but the pollution of such batteries is more serious. Only used in special industries, such as aviation, high-speed rail, etc. It is expected that in the next 5-10 years, cadmium-nickel batteries will also be the main energy storage battery material for railway backup power.

② The application of lead-acid batteries in China's railway standby power supply market has been gradually replaced by cadmium-nickel batteries, and at present only CRH2A models apply lead-acid batteries as backup power supplies, but in the future such models will be retired, so it is predicted that lead-acid batteries will exit the railway standby power supply market in the future.

(3) Lithium ion battery (lithium titanate battery) as an emerging energy storage battery material has officially entered the Chinese railway standby power market, lithium titanate battery is mainly used in CR400BF and CR400AF models, the battery in the temperature adaptability, battery life, safety meet the requirements of high-speed rail standby power supply and can effectively reduce environmental pollution. But such batteries are expensive, more than three times the price of cadmium-nickel batteries. In addition, because the technology is not mature enough, the failure rate of such batteries is currently high. With the gradual development of lithium titanate battery technology, the market share of lithium titanate battery will continue to rise in the next 5-10 years based on various factors.

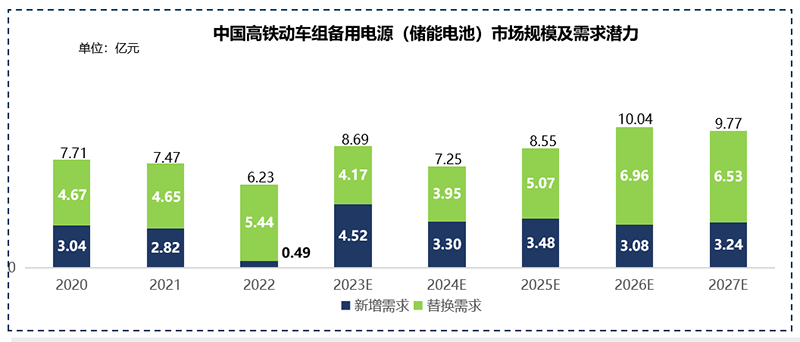

Railway standby power supply market size forecast:

Data source: Beijing Research Century Consulting

Figure 2 Market size and demand potential of standby power supply (energy storage battery) for China's high-speed rail EMUs in 2022-2027

In 2022, the overall market size of railway standby power supply is 623 million yuan. Due to the impact of COVID-19, the new demand is only 49 million yuan, which is far lower than the average in previous years, resulting in the delayed release of market demand. Therefore, it is predicted that the market demand for new standby power supply will increase significantly in 2023.

The future demand for standby power depends on the new production of high-speed rail EMUs and the replacement demand of existing high-speed rail EMUs. As China's high-speed train market has matured, it is expected that the new market demand for railway standby power supply market will remain at about 300 million yuan.