Homepage > CMRC understandings > 【CMRC】Cat.1 RF chip industry market analysis

Hits:3495 Createtime:2024-06-25 10:21:25

Cat.1 is a wireless performance classification standard for transfer terminal equipment under 4G LTE network. The target market is to serve the Internet of Things and achieve low-power and low-cost LTE connection. With the rapid development of domestic Cat.1 chips in the past five years, the market demand for Cat.1PA has also increased rapidly.

Cat.1 is mainly used for low - and medium-rate communication, with an upstream peak rate of 5Mbit/s and a downstream peak rate of 10Mbit/s. It belongs to the cellular Internet of Things and is a wide area network. CAT.1 PA refers to a RF front-end chip under the CAT.1 standard, which is one of the CAT.1 chips, including power amplifiers, controllers, switches and other devices, and is generally referred to as CAT.1 PA in order to facilitate the industry

As early as 2015, Qualcomm, Sequans, Altair and other chip manufacturers have launched Cat.1 chips. At the time, China's 4G network deployment was immature, and the speed price of Cat.1 was high.

Cat.1 RF chip market status

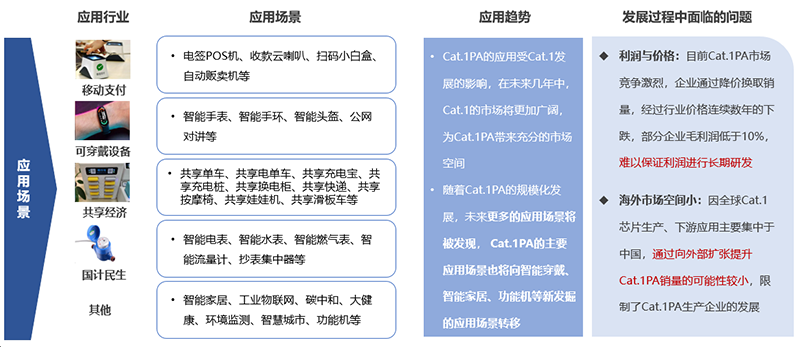

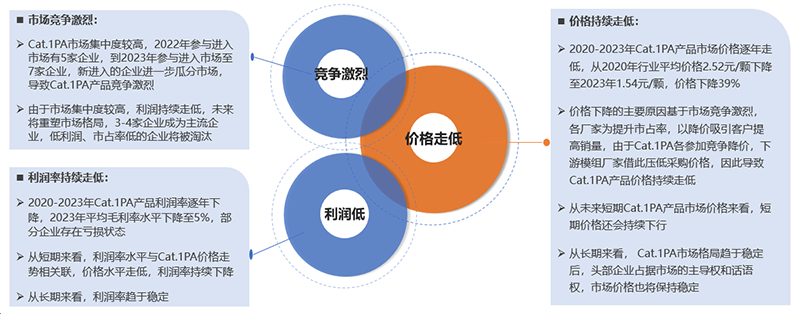

With the gradual maturity of the conditions for 2G/3G downscaling, the Cat.1 chip market has begun to regenerate since 2019. Optica Technologies (ASR) launched the ASR3601/1601 Cat.1 and GSM dual-mode chip, and Unigroup launched the world's first LTE Cat.1 bis chip platform, Chunteng 8910DM. These initiatives have led to the increasingly competitive pricing of Cat.1 modules. More enterprises enter the Cat.1PA market, with the lower price of Cat.1PA chip and the slowdown of industry demand growth, industry competition has intensified, and the price has decreased year by year.

Cat.1 RF chip competition

Although the Cat.1 chip market is starting to show vitality, it still faces stiff competition. In addition to the traditional Cat.4 chips, higher-level Cat.6, Cat.7 and even Cat.12 are also competing for market share. In addition, Cat.1 chips launched by different manufacturers also differ in performance, price, power consumption and other aspects, which further intensifies market competition. The Cat.1PA market has a relatively limited capacity, with 6-7 players already entering the market. In the future, new enterprises will enter the competition under greater pressure, and due to the low profits of the current industry and the serious homogenization of products, some enterprises will gradually face elimination.

In the Cat.1PA market in 2021, the main participating enterprises are Hui Zhiwei, Lixin, Rui Shi, Zhisheng and other enterprises. Overall, there are fewer participating enterprises, and some enterprises will gradually enter the market in 2022. In the Cat.1PA market in 2022, the main participating enterprises have increased to 5, and the market concentration is high, among which Hui Zhiwei and Xinpu are the main participating enterprises

In the Cat.1PA market, there are still new enterprise layouts ready to enter the market, in the short term, Xingyao Semiconductor and Anrui Micro will enter the market in 2023, increasing the competition pattern of the Cat.1PA market

Cat.1 RF chip future outlook

Despite many challenges, Cat.1 chips still have broad market prospects. With the rapid development and popularization of Internet of Things technology, more and more devices need to achieve low-cost, low-power, low-speed connection, and Cat.1 chip can just meet this demand. It is expected that the Cat.1 chip market will continue to grow in the next few years and become an important part of the iot space.

END

Although the Cat.1 chip market started late, it has made great progress in recent years. Although facing fierce competition, with the continuous expansion of the Internet of Things market, the market prospect of Cat.1 chips is still broad. In the future, with the continuous improvement of technology and the continuous reduction of cost, Cat.1 chip is expected to be applied in a wider range of fields.