Homepage > Industrial news > The blue ocean market brought by new energy vehicles, mastering the power battery recycling channel is the key to break the game.

Hits:1861 Createtime:2024-01-18 15:59:58

According to different use scenarios, the service life of the power battery is 5-8 years, therefore, it is judged that the first large-scale application of new energy vehicle power batteries in China around 2017 will usher in the first wave of retirement in 2023-2024. To realize the recycling and utilization of decommissioned power batteries has become an important strategic goal in the development of resource reuse in China.

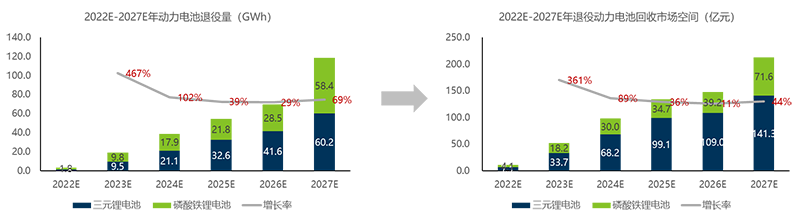

A large number of power batteries are decommissioned, bringing huge market space to the recycling industry. According to the forecast of the installed capacity of power batteries, the total amount of retired power batteries that can be recycled in China by 2027 will reach 118.6GWh; According to the calculation of the single ton recovery price of retired batteries, the market space will reach 21.3 billion yuan in 2027. The rapid development of new energy vehicles has driven the development of the downstream battery recycling industry, created a blue ocean of power battery recycling industry, and attracted large and small battery manufacturers, vehicle manufacturers, and third-party recyclers to layout and establish an industrial chain.

Figure 1 Forecast of market size of decommissioned power battery recycling in 2022E-2027E in China

Mastering the decommissioning power battery recycling channel is the key to enterprise survival:

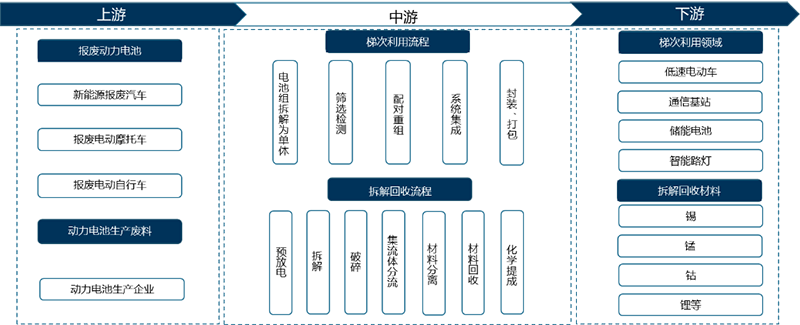

Power battery recycling is divided into two technical routes: cascade utilization and recycling. The industry has a typical front-end driven back-end development characteristics. The upstream of the industry is the provider of used batteries, as well as the material and equipment manufacturers needed for recycling, including the battery manufacturing and use links; The middle reaches are disassembly and recycling manufacturers and testing parties. In terms of echelon utilization, due to the highest correlation with the battery, the power battery enterprise layout is the most, in terms of dismantling and recycling, it is generally a third-party professional recycling enterprise layout; Downstream is mainly used in energy storage, low-speed electric vehicles and recyclable expensive metal fields. At present, the power battery recycling industry is still in the development stage, the industry standard is low, about 80% of the decommissioned batteries into small workshops, most of the formal recycling enterprises production line of raw materials more rely on factory waste (battery manufacturers produced in the production process of the corner waste) rather than decommissioned batteries. Because the formal channel battery sources are few, and there is no clear pricing mechanism for recycling prices, the recycling source of decommissioned batteries is very unstable. How to ensure a stable supply of recycled materials is the primary problem that enterprises need to solve at present.

Figure 2 Power battery recycling industry chain

"Car enterprise-battery enterprise-recycling enterprise" forms an industrial closed loop and builds a perfect recycling channel:

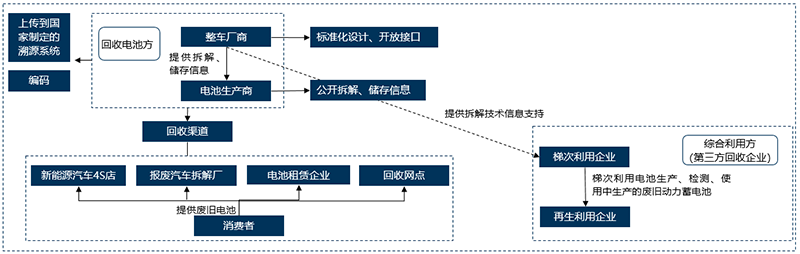

The power battery recycling market is divided according to the main body of recycling, the main players are automobile manufacturers, battery manufacturers, recycling enterprises, which have their own advantages; Car factories and battery manufacturing enterprises have the advantages of recycling channels, and recycling enterprises have the advantages of technology and scale, the cost is expected to continue to decline, and the formation of a closed-loop industry will be a win-win-win situation. Waste battery recycling channel is the most important link in the entire recycling chain, mastering upstream resources will greatly enhance the right to speak of the industry chain, from the perspective of resources, vehicle factories and battery factories have natural advantages. In recent years, the binding trend of domestic car enterprises and battery factories and recycling enterprises has become increasingly obvious;

Vehicle manufacturers: channel, logistics advantages. With the perfect automobile sales network, the waste battery recycling can be efficiently completed. From the perspective of consumption habits, consumers are used to contacting 4S stores for communication and solution of car-related problems, which is more conducive to direct battery recycling by car companies;

Battery manufacturers: channel advantage, resource autonomy. Battery production with its own sales channels to help achieve efficient recycling of used batteries; Battery production enterprises produce more scraps in production, and need to cooperate with recycled lithium, nickel and cobalt enterprises to form the "production → consumption → recovery → resource regeneration → production" of resources;

Recycling enterprises: technical advantages, recycling channels are weak. Recyclable mode recycling enterprises have more mature technology and internal structure, and usually have a team dedicated to purchasing waste for multi-angle and wide field recycling. However, the core is that there is no battery recycling channel, so it is generally used to obtain waste in the form of cooperation with car factories and battery factories.

Figure 3 Market role MAP

At present, the regular manufacturers involved in battery recycling are mostly third-party recycling enterprises, in addition to recycling companies, battery manufacturers, vehicle manufacturers have also been involved through self-built production lines or acquisitions, participation and other ways, it is expected that the future industrial chain upstream and downstream strategic alliance and cooperation will be more in-depth, accelerate the construction of recycling channel network.

Online consultation

>Hotline

400-966-0397